具体描述

威廉·欧奈尔,(William J.ONeil),欧奈尔是华尔街经验最丰富、最成功的资深投资人之一。他21岁白手起家,30岁时就买下纽约证券交易所的席次,并在洛杉矶创办执专业投资机构之牛耳的威廉·欧奈尔公司。他目前是全球600位基金经理的投资顾问,并且担任资产超过2亿美元的新美国共同基金的基金经理,也是《投资者商业日报》的创办人。该报成长迅速,是《华尔街日报》的主要竞争对手。

在线阅读本书

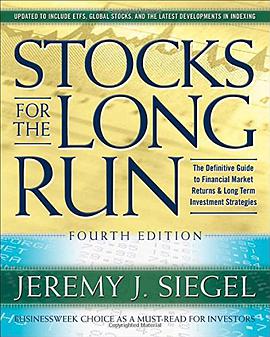

A BUSINESSWEEK BESTSELLER! Anyone can learn to invest wisely with this bestselling investment system! Through every type of market, William J. O’Neil’s national bestseller, How to Make Money in Stocks , has shown over 2 million investors the secrets to building wealth. O’Neil’s powerful CAN SLIM® Investing System—a proven 7-step process for minimizing risk and maximizing gains—has influenced generations of investors. Based on a major study of market winners from 1880 to 2009, this expanded edition gives you: Proven techniques for finding winning stocks before they make big price gains Tips on picking the best stocks, mutual funds, and ETFs to maximize your gains 100 new charts to help you spot today’s most profitable trends PLUS strategies to help you avoid the 21 most common investor mistakes! “I dedicated the 2004 Stock Trader’s Almanac to Bill O’Neil: ‘His foresight, innovation, and disciplined approach to stock market investing will influence investors and traders for generations to come.’”

—Yale Hirsch, publisher and editor, Stock Trader’s Almanac and author of Let’s Change the World Inc. “ Investor’s Business Daily has provided a quarter-century of great financial journalism and investing strategies.”

—David Callaway, editor-in-chief, MarketWatch “ How to Make Money in Stocks is a classic. Any investor serious about making money in the market ought to read it.”

—Larry Kudlow, host, CNBC’s "The Kudlow Report" Normal 0 7.8 磅 0 2 false false false EN-US ZH-CN X-NONE MicrosoftInternetExplorer4 <!-- /* Font Definitions */ @font-face {font-family:宋体; panose-1:2 1 6 0 3 1 1 1 1 1; mso-font-alt:???????????????????????????????; mso-font-charset:134; mso-generic-font-family:auto; mso-font-pitch:variable; mso-font-signature:3 135135232 16 0 262145 0;} @font-face {font-family:"Cambria Math"; panose-1:2 4 5 3 5 4 6 3 2 4; mso-font-alt:"Calisto MT"; mso-font-charset:0; mso-generic-font-family:roman; mso-font-pitch:variable; mso-font-signature:-1610611985 1107304683 0 0 159 0;} @font-face {font-family:"\@宋体"; panose-1:2 1 6 0 3 1 1 1 1 1; mso-font-alt:"Times New Roman"; mso-font-charset:134; mso-generic-font-family:auto; mso-font-pitch:variable; mso-font-signature:3 135135232 16 0 262145 0;} /* Style Definitions */ p.MsoNormal, li.MsoNormal, div.MsoNormal {mso-style-unhide:no; mso-style-qformat:yes; mso-style-parent:""; margin:0cm; margin-bottom:.0001pt; text-align:justify; mso-pagination:widow-orphan; font-size:10.5pt; font-family:"Times New Roman","serif"; mso-fareast-font-family:宋体;} .MsoChpDefault {mso-style-type:export-only; mso-default-props:yes; font-size:10.0pt; mso-ansi-font-size:10.0pt; mso-bidi-font-size:10.0pt; mso-ascii-font-family:"Times New Roman"; mso-fareast-font-family:"Times New Roman"; mso-hansi-font-family:"Times New Roman"; mso-font-kerning:0pt;} /* Page Definitions */ @page {mso-page-border-surround-header:no; mso-page-border-surround-footer:no;} @page Section1 {size:612.0pt 792.0pt; margin:72.0pt 90.0pt 72.0pt 90.0pt; mso-header-margin:36.0pt; mso-footer-margin:36.0pt; mso-paper-source:0;} div.Section1 {page:Section1;} --> /* Style Definitions */ table.MsoNormalTable {mso-style-name:普通表格; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-qformat:yes; mso-style-parent:""; mso-padding-alt:0cm 5.4pt 0cm 5.4pt; mso-para-margin:0cm; mso-para-margin-bottom:.0001pt; mso-pagination:widow-orphan; font-size:10.5pt; mso-bidi-font-size:11.0pt; font-family:"Calibri","sans-serif"; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-fareast-font-family:宋体; mso-fareast-theme-font:minor-fareast; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin; mso-bidi-font-family:"Times New Roman"; mso-bidi-theme-font:minor-bidi; mso-font-kerning:1.0pt;} 说明 :第三版和第四版的目录虽然是一样的,但第四版更新了以下内容,以便读者更好地根据今天动荡的时代进行投资: * 更好地阐述 CAN SLIM 的关键投资策略; * 市场新赢家的新模式; * 新的股票分析表; * 使用该模式的现实成功故事; * 投资组合新信息,对冲基金的影响。

用户评价

一直读不进去,跟着爸爸看了几天K线再回头读它就秒懂了~

评分 评分 评分##CAN SLIM, excellent introduction book.

评分相关图书

本站所有内容均为互联网搜索引擎提供的公开搜索信息,本站不存储任何数据与内容,任何内容与数据均与本站无关,如有需要请联系相关搜索引擎包括但不限于百度,google,bing,sogou 等

© 2025 book.coffeedeals.club All Rights Reserved. 静流书站 版权所有